It was another day of declines in the crypto market as Bitcoin (BTC) continues to bleed in the midst of large sales by Grayscale, which is selling on behalf of investors who want to cash in their GBTC to take profits or rotate into ETFs with lower fees.

“We think the catalyst in Bitcoin ETFs that has pushed the ecosystem out of its winter will disappoint market participants,” said JPMorgan analysts led by Kenneth Worthington in a note on Monday that explained why they downgraded Coinbase Global (COIN) to underweight from neutral.

“We see greater potential for cryptocurrency ETF enthusiasm to further deflate, driving with it lower token prices, lower trading volume, and lower ancillary revenue opportunities for firms like Coinbase,” Worthington added, giving COIN a price target of $80, which represents a 38% drop from Monday’s close.

Stocks traded mixed on Tuesday as a slew of earnings reports showed some sectors of the economy firing on all cylinders while others are struggling. The S&P bounced back from early pressure to gain 0.29% and closed just below the all-time high set on Monday, while a late afternoon rally pushed the Nasdaq to a new record high and a gain of 0.43% on the day. The Dow traded underwater from the market open and closed down 0.25%.

Data provided by TradingView shows that Bitcoin bulls were rejected in their early attempt to reclaim support at $40,000, which led to a pullback to a daily low of $38,500. At the time of writing, BTC trades at $39,160, a decrease of 2.45% on the 24-hour chart.

BTC/USD Chart by TradingView

According to cycles trader Bob Lukas, the weekly cycle has topped, and crypto traders can expect sideways or declining price action for the foreseeable future.

BTC/USD 1-week chart. Source: X

“Mid-February best case for lows IMO if it’s a price rout,” he said. “March is best cycle timing for low. Good to see some fear build up over time.”

While some are bemoaning the price decline for Bitcoin, others recognize that the price action had gotten frothy with the launch of the spot BTC ETFs, and a pullback was due.

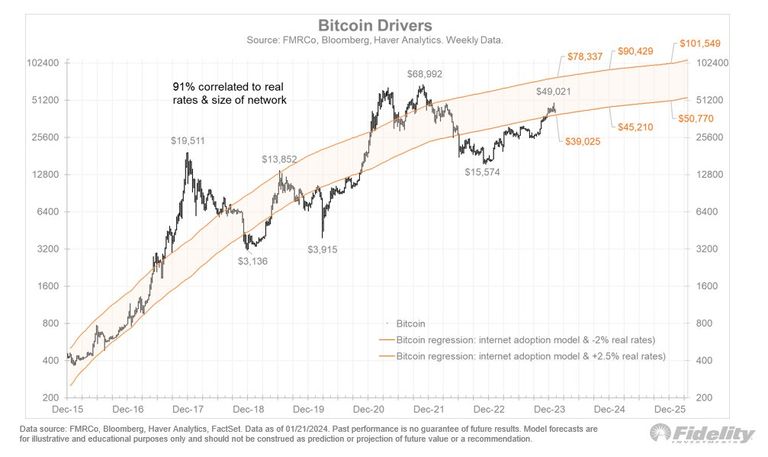

“Bitcoin’s price has traveled back into what I consider its fair value band,” tweeted Jurrien Timmer, director of Global Macro at Fidelity Investments.

Bitcoin drivers. Source: X

“The slope of the curve is based on the internet adoption curve a few decades ago, and the width is based on a real rate band of -2% (top) and +2.5% (bottom),” he said.

A longer-term outlook was provided by market analyst Rekt Capital, who said that Bitcoin will eventually surpass $46,000 with ease, but it’s unlikely to do so until after the halving in late April.

Each Candle 4 breaks its Four Year Cycle resistance (black)

Thus, Bitcoin will comfortably break $46000 resistance this year but most likely only after the Halving$BTC #Crypto #Bitcoin pic.twitter.com/QWEgqoIZTM

— Rekt Capital (@rektcapital) January 23, 2024

And crypto trader Bloodgood said he “will start deploying cash back to Bitcoin with [the] biggest bid at 36500,” while the “Rest of the cash will go to altcoins when [the] market bounces with force.”

Altcoins deep in the red

Altcoins continued to get hammered lower as only nine tokens in the top 200 recorded gains on Tuesday.

Daily cryptocurrency market performance. Source: Coin360

Huobi Token (HT) had the best performance, gaining 11.45% to trade at $2.05, while Chiliz (CHZ) climbed 3.38%, and Aptos (APT) gained 3.1%. ORDI (ORDI) led the losers, declining 17.65%, while SATS (1000SATS) fell 16.1%, and Decentralized Social (DESO) lost 15.4%.

The overall cryptocurrency market cap now stands at $1.52 trillion, and Bitcoin’s dominance rate is 50.4%.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.