(Kitco News) – It was a day of consolidation for the broader cryptocurrency market on Thursday as Bitcoin slid below $43,000 while many of the altcoins that had seen large price increases over the past week or two corrected lower as traders booked profits.

Stocks were higher for the majority of the trading day as investors looked to finish 2023 with the same strength that has pushed the S&P and Dow to record highs in recent days. But traders ran out of steam into the close, resulting in a flat performance for the S&P and Nasdaq, while the Dow gained 0.14%.

Data provided by TradingView shows that after Bitcoin (BTC) bulls pushed its price to a daily high of $43,835 in the early hours on Thursday, bears took control of the price action and dropped the top crypto to a low of $42,265 in the afternoon before bulls managed to halt the slide. At the time of writing, Bitcoin trades at $42,600, a decrease of 1.75% on the 24-hour chart.

BTC/USD Chart by TradingView

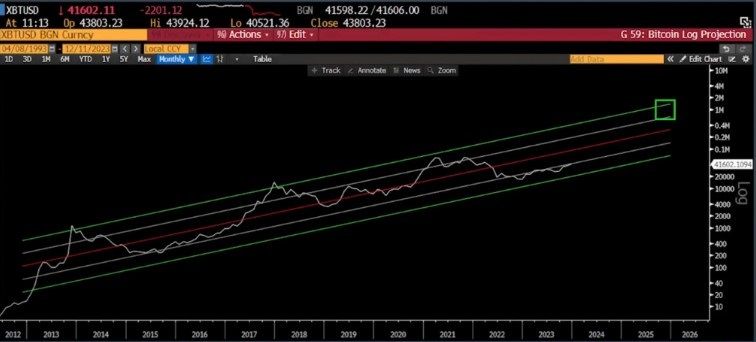

According to former Goldman Sachs executive Raoul Pal, the gains seen so far in 2023 are but the start of a crypto bull market cycle that could last up to four years and see Bitcoin hit a high of $1 million by 2025.

Looking at a long-term chart of Bitcoin’s performance since 2013 that Pal said is “a perfect logarithmic trend” chart, he said that his firm thinks “the business cycle peaks sometime at the end of 2025, and that would suggest a crazy sort of target that could get somewhere between half a million and a million dollars in Bitcoin.”

“Do I expect that? Probably not, but who the hell knows right?” Pal said.

He went on to suggest that the current bull market cycle is similar to the 2016-2017 cycle which saw digital asset prices surge higher as the result of a large influx of liquidity, and said that with the launch of a spot BTC ETF on the horizon and the approaching Bitcoin halving in April, this bull market is still in its early stages and has a long way to run.

“These cycles can be crazy and this one feels more like the 2016-17 cycle than it does the prior cycle. And that cycle didn’t have a lot of central bank printing, not in the US,” Pal said. “But central bank balance sheets were rising. We saw a 20% growth in liquidity. And what happened was crypto absolutely exploded. I kind of feel like that’s the case. I don’t focus on the end target. I focus on the structure. But I’m just showing you the magnitude of the opportunity. And we’re still at one standard deviation oversold. It’s all to play for. We’ve barely started.”

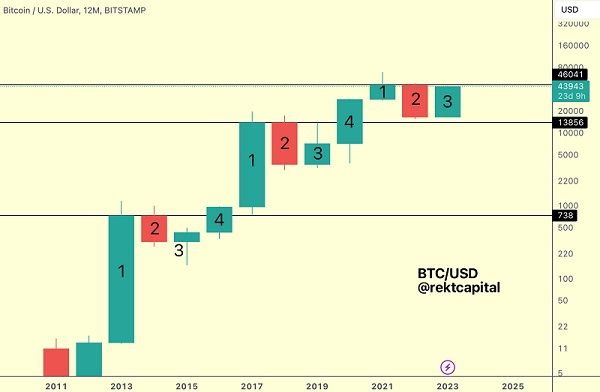

Crypto trader Nestay also thinks the current cycle is similar to what was seen in 2015-2017, and coined the term “golden cycle” to describe Bitcoin bull markets.

“So far, our current golden cycle is most similar to the ’15-’17 one,” he said. “We started off with a crash, but it recovered fast, a re-accumulation period followed, and now we are heading into the golden rejection.”

During the 2015-2017 cycle, the golden rejection took place near $800 in mid-late June and was followed by a pullback to the previous resistance at $480, which flipped to support. After that, BTC’s price steadily climbed higher until it underwent a blow-off top in late 2017.

“If we do reject [near $50,000], I expect us to S/R flip the re-accumulation range,” Nestay said. “Like each past golden cycle, a re-accumulation phase follows into the halving before the bull begins his run and sends us into new ATHs,” he concluded.

“In every Four Year Cycle, there is always a resistance that rejects price for 3 years (black),” said market analyst Rekt Capital. “But in a new Candle 4, this resistance is finally broken.”

“In this four-year cycle that resistance is $46,000,” he said. “In 2024, BTC will break $46,000 easily.”

Altseason fades away

The majority of tokens in the top 200 traded in the red on Thursday as traders looked to decrease their exposure ahead of a potential market-wide correction lower.

Bitcoin Gold (BTG) was the biggest gainer with an increase of 24%, followed by a 23% gain for Bitcoin SV (BSV), and a 14% increase for Tellor (TRB). Decred (DCR) was the biggest loser with a decline of 18%, while Kadena (KDA) fell 15.5%, and Raydium (RAY) lost 12.8%.

The overall cryptocurrency market cap now stands at $1.67 trillion, and Bitcoin’s dominance rate is 50%.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.