Written by Finn O’Hara

Cryptocurrency has emerged as a revolutionary financial and technological innovation, fundamentally changing the way we perceive and utilize currency. While traditional currencies are issued and regulated by governments and central banks, cryptocurrencies operate on decentralized, blockchain-based platforms. This essay will provide a comprehensive, fact-based overview of cryptocurrency, covering its history, technology, adoption, and economic impact.

Cryptocurrency’s introduction can be traced back to 2009 when someone known as Satoshi Nakamoto, introduced Bitcoin, the first decentralized digital currency. Bitcoin’s underlying technology, blockchain, became the basis for many other cryptocurrencies. Over time, the cryptocurrency ecosystem has evolved, with thousands of different cryptocurrencies now in circulation, each with unique features and use cases.

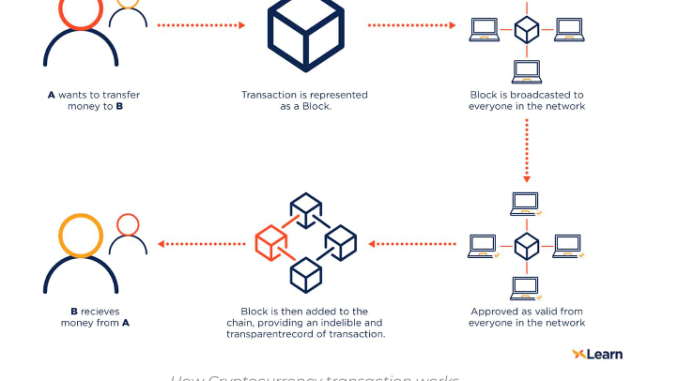

Blockchain technology is the foundation of all cryptocurrencies. It is basically a record book, or a distributed ledger that records every transaction across a network of computers, making it secure and tamper-resistant. Transactions are grouped into blocks, and each new block is cryptographically linked to the previous one, forming a chain. This transparent and decentralized ledger technology ensures the integrity and immutability of transaction data, reducing the need for mediators in financial transactions.

Cryptocurrency adoption has seen remarkable growth in recent years. Bitcoin, as the pioneer, has gained significant recognition, with numerous businesses accepting it as a form of payment. Additionally, several countries have started exploring the development of central bank digital currencies (CBDCs) as a way to enhance their payment systems and streamline cross-border transactions.

The adoption of cryptocurrencies extends beyond Bitcoin. Ethereum, the second-largest cryptocurrency by market capitalization, introduced smart contracts, enabling the creation of decentralized applications (DApps). These DApps have found applications in various industries, from finance to healthcare, and have opened up new avenues for innovation.

The cryptocurrency market has exhibited substantial growth and big fluctuations. As of 2022 the total market capitalization of all cryptocurrencies surpassed $2 trillion. Bitcoin, as the largest cryptocurrency, represented a substantial portion of this market cap. However, cryptocurrencies are known for their price fluctuation, with rapid and unpredictable price swings. Factors such as regulatory changes, technological developments, and market value can all influence cryptocurrency prices.

The regulatory landscape for cryptocurrencies varies from country to country. While some countries have embraced cryptocurrencies and established regulatory frameworks to govern their use, others have implemented strict measures or outright bans. The United States, for example, has developed a regulatory approach that includes classifying cryptocurrencies as property for tax purposes and subjecting exchanges to anti-money laundering (AML) and know-your-customer (KYC) regulations.

While blockchain technology offers enhanced security through its decentralized and transparent nature, the cryptocurrency space is not immune to security issues. Hacks, scams, and fraud have been prevalent in the industry. It is crucial for users to store their cryptocurrencies in secure wallets and exercise caution when engaging in cryptocurrency-related activities.

The economic impact of cryptocurrencies extends beyond trading and investment. They have created new opportunities for businesses and individuals. For instance, the DeFi (Decentralized Finance) sector has emerged, offering decentralized lending, borrowing, and trading services without traditional financial intermediaries. Cryptocurrencies also provide an alternative store of value and a means of transferring funds across borders with reduced fees.

Cryptocurrency represents a remarkable innovation in the world of finance and technology. Its history, blockchain technology, adoption, market capitalization, regulatory environment, security concerns, and economic impact are key aspects to consider when examining this dynamic and rapidly evolving field. As the cryptocurrency landscape continues to evolve, it remains essential to stay informed and exercise caution when participating in this new financial innovation.

Works Cited

Nakamoto, S. (n.d.). A peer-to-peer electronic cash system. Bitcoin. https://bitcoin.org/en/bitcoin-paper

Buterin, Vitalik. “Ethereum Whitepaper.” Ethereum.Org, 2014, ethereum.org/en/whitepaper/.

“What Is a Central Bank Digital Currency?” Board of Governors of the Federal Reserve System, www.federalreserve.gov/faqs/what-is-a-central-bank-digital-currency.htm. Accessed 27 Oct. 2023.

Desk, News. “News, Insights & Data.” CryptoSlate, 13 Apr. 2023, cryptoslate.com/.

Disclaimer: The author of this article is not a licensed finance professional. This article is meant for educational purposes only. Crypto and investing are risky. Remember to do your own research.