Blockchain leader Coinbase Global (COIN) has struggled this quarter, down 10% since Q3 kicked off at the beginning of the month. The equity is also far removed from its March 25, more than two-year high of $283.48. However, COIN’s recent pullback could be short-lived, as the equity approaches a historically bullish trendline.

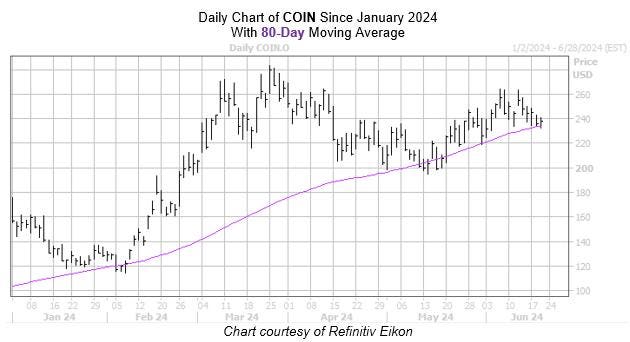

Per data from Senior Quantitative Rocky White, Coinbase stock is within one standard deviation of its 80-day moving average, after spending a lengthy amount of time above it. The security saw six similar signals in the past three years, after which it was higher one month later 67% of the time, averaging an outsized 23% gain. Last seen 1.2% higher at $238.78, a move of similar magnitude from the stock’s current perch would put it at roughly $293.70 – levels not seen since December 2021.

Daily chart of Coinbase Stock with its 80-day moving average

Despite a 308% year-over-year lead and a 36.4% year-to-date gain, analysts are still bearish on COIN. Of the 21 covering brokerages, 11 recommend a “hold” and two rate the stock a “strong sell.” An unwinding of this pessimism could put help push Coinbase stock higher.

Even further, Coinbase Global stock’s Schaeffer’s Volatility Scorecard (SVS) stands at a 71 out of 100, indicating the stock exceeded option traders’ volatility expectations in the past 12 months — a boon for premium buyers.