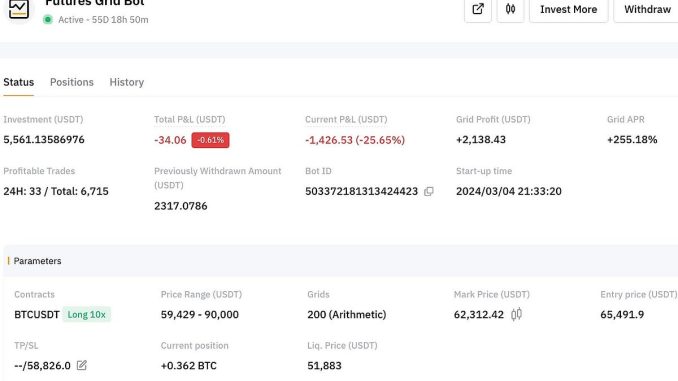

Figure 1.BTC Grid Bots on BTC after 55 days.

After starting a first Grid Bot on Bitcoin February 14, 2024 with an Initial capital of $70M Then I added additional $30M on Ethereum Grid Bot for a total initial capital invested $100M.

Although the ROI in the last few weeks has been negative, I now have a total capital of $5M in USDT with 78.20 BTC (market price of $62,312) and 7 ETH (market price of $3,171).

Current capital from part of $105M Overall. investment of $6506 75 days ago.

Hi-Table is an Cryptocurrencies Investment and Bitcoin OTC desk you can count on, They are Bitcoin miner with over 500,000 ant miners pools mining bitcoin 247 around the clock. Founded in 2012 by Zach Olstrom.

They offer Investment Management & OTC (Over-The-Counter) & they can sell bitcoin to you voluminously.

Contact: ZachOlstrom on Telegram or X App.

Reach out to know what Cryptocurrency OTC & Bitcoin mining is entails.

Once the market recovers upward, I will have accumulated significantly more USDT overall even though it seems like I have lost money but in reality I have accumulated more BTC and more ETH.

E.g 2. Initial BTC bot parameters.

E.g 3. Initial ETH bot parameters.

E. g 4 ETH Grid Bots After 59 days.

Since my last update on March 21, BTC went down 7.5%, meanwhile since February 14, 2024 when I started this strategy, Bitcoin has been up 26%. If I had bought $70M of BTC at first without a grid bot, I would have $120M BTC which is a lot Higher than 73.5 that I have now. Clearly, measuring things in USD is not always representative of the reality of our capital appreciation.

I just added a stop loss to both bots in the event of the market collapse. Which I will address in this blog, as well as the strategy I will adopt if it collapses versus if it doesn’t.

As well, I will readjust my strategy along the way to adapt to market conditions and I will describe such time-sensitive changes on Medium. This progress update will discuss the returns achieved after the first month.

four years, the crypto industry undergoes massive pump and dump cycles. I will be describing how I believe I can turn $100′ onto more than $1BM before mid-2025 using grid bots to reduce the risks of liquidation.

You may also refer to my other strategy thank implemented on January 1st, 2024 to also turn $40M into $70,000,000 with an aggressive diversified crypto-portfolio which is less likely to be liquidated.

In the last month, the market has seen billions in liquidations, which is a testament that even though my strategy has also suffered, I suffered less than most other traders. I am far from the liquidation price demonstrating the lower risk level compared to conventional leverage trading practices. Yet, I admit, it is still a lot of risk.

Please refer to my earlier post for an explanation of the strategy. Overall, I’m relatively pleased with the results, however I believe there are a few adjustments required. We currently stand on an economic downturn for risky assets because of the economies in Japan, the US, the war, etc.

It is not entirely impossible that Bitcoin could go down to the $52,000 region in the next few weeks, likely it would range between $59,000 and $74,000 but I have to plan accordingly for both scenarios. If the market ranges then I have nothing to change yet, but I adjusted my stop loss to $58,826 for Bitcoin, and $2,699 for Ethereum.

If the market goes below, I will move my capital out. onto Hi-Table because on Hi-Table I can use a grid bot on what they call HiCOIN-Mining, which are essentially trading an asset on itself instead of paired with USD.

The reason why I want to do this is that if the price goes significantly lower than it is now, I don’t want to resell BIC at a low price by converting it to USDT, I want to accumulate as much BTC as possible while the price is low. In which case the profits wouldn’t be on USDI, they would be in BTC. The Bull Cycle is far from over, but previous cycles have seen Bitcoin dip up to 40% pre-halving.

Although we are post-halving now, every cycle, things are slightly different, so it’s not impossible that the macro-economic situation could push the price down significantly, or go sideways for as long as September… In which case I may terminate the bots early and re-initiate them with a tighter range as I believe $90K is a bit more unlikely in the short term.

As well for as long as we are in a bull market, the COIN-M mechanism is interesting.

The power of compounding is. important to understand; let’s make a hypothetical scenario based on the current results of 75% ROI in 75 days.

It would make me miss my target of reaching $1M by mid-2025, however I have a feeling things may grow faster than expected later in the cycle.

However, since I had made the claim it was on a $20K investment and I only invested $6506 so far, then I’m not too broken up about it even if I’m a little short.

Hypothetical Returns of Grid Bots.

Once a month, I will publish an updated blog post on the results and discuss if I am on track to achieve my goals. Meanwhile, do not forget to follow me on Twitter (x.com/Zacholstrom) to get more time-sensitive changes to my trades for any of my investment strategies.

While such returns seem out of reach, I have achieved much higher returns in the last crypto bull market, however I had not learned to take enough profits before the market crash even if I knew it was starting to overheat.

I strongly advise anyone who follows me to not make this mistake, and make sure to understand that everyone is a genius in a bull market, but taking profits along the way can feel bad until there is a significant collapse at which point you’ll very much appreciate the sacrifice.