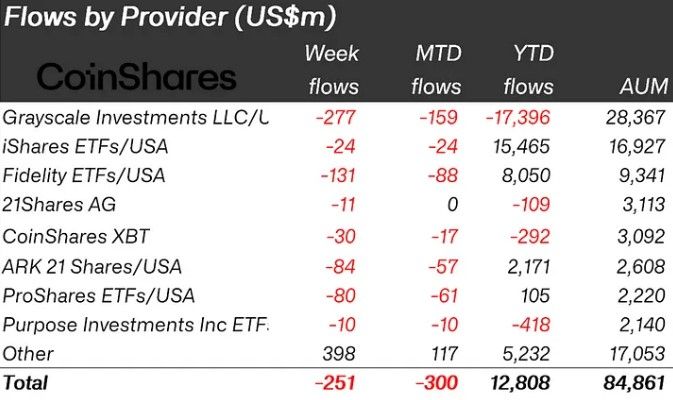

(Kitco News) – Digital asset investment products recorded their fourth consecutive week of outflows during the week ending May 3, with the collective assets under management (AUM) declining by $251 million to $84.86 billion.

It was also “the first week to see any measurable outflows from the newly issued ETFs in the U.S., which saw US$156m outflows last week,” said James Butterfill, Head of Research at CoinShares. “We estimate the average purchase price of these ETFs since launch to be US$62,200 per Bitcoin (BTC), as the price fell 10% below that level, it may have triggered automatic sell orders.”

The outflows from the spot BTC ETFs mean that the U.S. accounted for the majority of the decline in AUM with $504 million in outflows, while Switzerland, Canada, and Germany saw drawdowns of $9.8 million, $9.6 million, and $7.3 million, respectively.

“The bright spot last week was the successful launch of spot-based Bitcoin and Ethereum ETFs in Hong Kong, which saw US$307m inflows in the first week of trading,” Butterfill said.

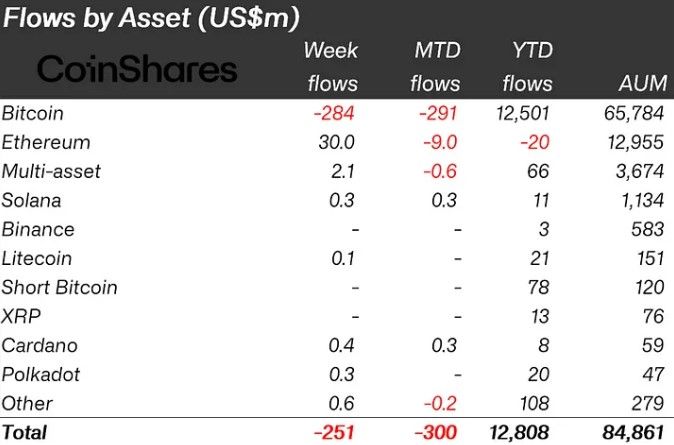

In an unusual turn of events, Bitcoin was the only token to see outflows, with $284 million pulled from funds, while Ethereum (ETH) broke its seven-week streak of outflows to record inflows of $30 million.

“A wide range of altcoins saw inflows, with the most significant being Avalanche, Cardano and Polkadot, seeing US$0.5m, US$0.4m and US$0.3m respectively,” Butterfill said.

Exchange flows dwindle

Another set of flow data that crypto investors are watching is Bitcoin inflows into cryptocurrency exchanges, which recently hit the lowest point in nearly a decade, suggesting a bullish revival is on the horizon.

The number of people wanting to sell BTC has been decreasing since February 2018. The MA-365D Exchange Inflow has dropped from 90K to 36K.

The current trend for Bitcoin Exchange Inflow is 20K BTC, a similar situation occurred in 2015.#deficit pic.twitter.com/YGNUOPBWqj

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) May 6, 2024

As shown in the graph provided by CryptoQuant analyst Axel Adler, Bitcoin inflows into exchanges sit at 20,000 Bitcoin, the lowest value the market has seen since 2015.

At the same time, Adler noted that long-term hodlers have also stopped distributing their tokens and started reaccumulating, which has historically been bullish.

Experienced investors Long-Term Holders (LTH) at the 70K level have finished distributing coins to new investors.

This week the oscillator will turn blue 🔵, indicating the cohort’s transition to the active accumulation phase. pic.twitter.com/H7NYStSAZC

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) May 6, 2024

Data provided by Alternative shows that the overall sentiment in the crypto market remains in “Greed” territory, which some analysts say means that further weakness is needed to ensure that the excess froth is cleared from the market.

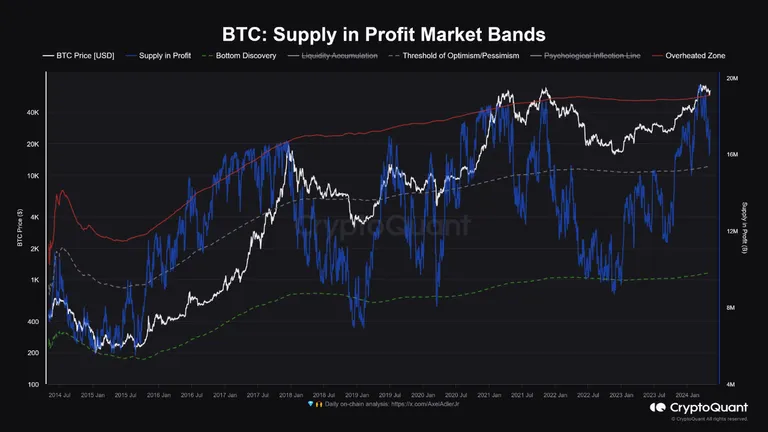

But according to analyst Kripto Mevsimi, that could soon change as “We are approaching the ‘grey line’ [in the chart below], which serves as the optimism/pessimism threshold for the crypto market.”

“The blue line, representing the proportion of Bitcoin supply currently in profit, is notably high,” Mevsimi said. “This generally indicates that a significant portion of the market might be considering realizing gains, potentially leading to increased selling pressure. Historically, such elevated levels have often preceded market volatility and potential downturns as holders begin to liquidate their positions.”

As the metric gets closer to the grey line, “Market participants should be vigilant; crossing below this line could lead to a deeper correction in prices,” he warned. “However, if we remain above this line, market sentiment is likely to stay positive, and any correction could be short-lived.”

“Profitability is a crucial factor in market psychology, especially when macroeconomic conditions, such as the current non-supportive economic expansionary monetary policies, do not favor risk assets,” Mevsimi concluded. “Participants should carefully monitor these dynamics as they can significantly influence market movements.”

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.